Rumored Buzz on Simply Solar Illinois

Table of ContentsFascination About Simply Solar IllinoisNot known Facts About Simply Solar IllinoisAll about Simply Solar IllinoisOur Simply Solar Illinois StatementsSimply Solar Illinois Fundamentals Explained

Our team companions with neighborhood areas across the Northeast and past to provide clean, budget-friendly and trustworthy power to promote healthy communities and keep the lights on. A solar or storage space job provides a number of advantages to the neighborhood it serves. As innovation breakthroughs and the expense of solar and storage decline, the economic benefits of going solar proceed to increase.Support for pollinator-friendly environment Environment reconstruction on polluted sites like brownfields and land fills Much required shade for animals like lamb and fowl "Land banking" for future farming usage and soil top quality improvements As a result of climate change, severe weather is coming to be extra regular and turbulent. Therefore, house owners, businesses, areas, and utilities are all becoming an increasing number of interested in protecting energy supply services that offer resiliency and power safety and security.

Ecological sustainability is one more key motorist for organizations spending in solar power. Several firms have durable sustainability goals that include decreasing greenhouse gas exhausts and making use of much less sources to assist reduce their effect on the native environment. There is an expanding seriousness to deal with climate adjustment and the stress from consumers, is arriving degrees of companies.

The Greatest Guide To Simply Solar Illinois

As we approach 2025, the assimilation of photovoltaic panels in business projects is no much longer just an option however a tactical requirement. This blogpost explores how solar power works and the diverse benefits it offers business buildings. Photovoltaic panel have been made use of on domestic buildings for several years, but it's just recently that they're coming to be more usual in commercial building.

In this write-up we discuss exactly how solar panels job and the benefits of making use of solar energy in industrial structures. Power costs in the U.S. are raising, making it more costly for services to run and more challenging to intend ahead.

The U - Simply Solar Illinois.S. Energy Info Administration anticipates electrical generation from solar to be the leading resource of development in the U.S. power sector through the end of 2025, with 79 GW of new solar capability projected to come online over the next two years. In the EIA's Short-Term Energy Expectation, the company said it expects renewable energy's overall share of electrical power generation to increase to 26% by the you could look here end of 2025

Indicators on Simply Solar Illinois You Need To Know

The sunshine causes the silicon cell electrons to set in activity, developing an electrical present. The photovoltaic or pv solar cell absorbs solar radiation. When the silicon interacts with the sunlight rays, the electrons begin to move and develop a circulation of direct electric existing (DC). The cables feed this DC electricity into the solar inverter and convert it to rotating power (AIR CONDITIONER).

There additional info are numerous methods to save solar power: When solar power is fed right into an electrochemical battery, the chain reaction on the battery components maintains the solar energy. In a reverse response, the present exits from the battery storage space for consumption. Thermal storage space utilizes tools such as molten salt or water to preserve and take in the heat from the sunlight.

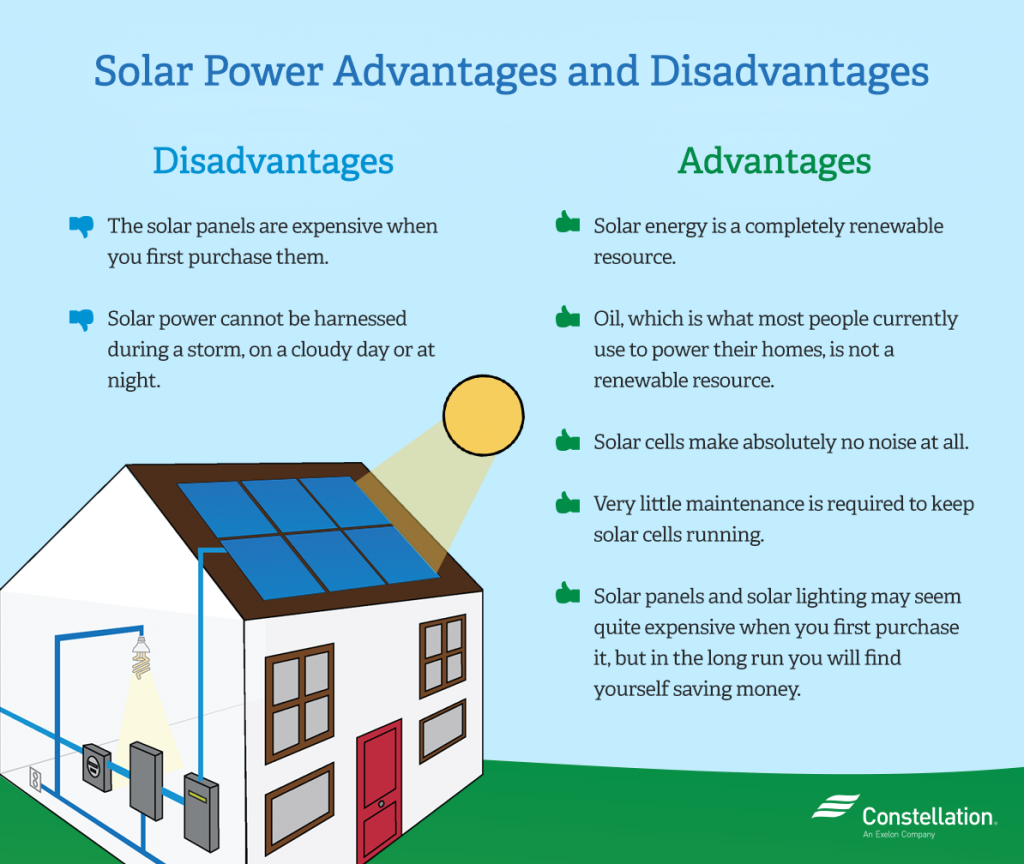

Solar panels dramatically lower power expenses. While the preliminary investment can be high, overtime the cost of mounting solar panels is recovered by the money saved on electricity costs.

Excitement About Simply Solar Illinois

By installing photovoltaic have a peek at this website panels, a brand shows that it cares regarding the atmosphere and is making an initiative to lower its carbon impact. Buildings that rely entirely on electric grids are susceptible to power interruptions that take place throughout poor weather condition or electric system breakdowns. Photovoltaic panel mounted with battery systems permit business structures to continue to function during power outages.

The smart Trick of Simply Solar Illinois That Nobody is Talking About

Solar power is just one of the cleanest types of power. With resilient service warranties and a production life of as much as 40-50 years, solar financial investments contribute substantially to ecological sustainability. This shift towards cleaner power resources can lead to wider financial advantages, consisting of decreased environment adjustment and ecological degradation expenses. In 2024, house owners can benefit from federal solar tax incentives, allowing them to balance out virtually one-third of the acquisition cost of a planetary system through a 30% tax debt.